First, we know that oatmeal is one of the healthiest breakfast choices. It’s gluten free and helps reduce cholesterol.

Oat milk is a plant milk derived from whole oat grains by extracting the plant material with water. The creamy flavor is available in flavors, such as sweetened, unsweetened, vanilla or chocolate.

There is natural sugar in oat milk but it us high in carbohydrates. One cup (240 mL) provides 17 grams of net carbs, It has more riboflavin, and vitamin B-2 than cow’s milk, but that may be due to certain manufacturers adding additional vitamins and minerals to increase the nutritional value of the drink. Dairy alternatives are extremely popular due to many people being lactose intolerant.

Compared with the control drink, intake of oat milk resulted in significantly lower serum total cholesterol (6%, p = 0.005) and LDL cholesterol (6%, p = 0.036) levels. The decrease in LDL cholesterol was more pronounced if the starting value was higher (r = -0.55, p < 0.001).

Recently, a couple of companies have become public and are on supermarket store shelves. The companies have potential to make a big dent into the milk, soy, and almond milk shelf space.

Even Starbucks has gotten on the oat milk bandwagon offering it at over 3500 locations. It sold out in Spring 2021 due to its popularity, people were taking to Twitter asking if there was a shortage of the dairy alternative.

Nielsen research reported sales of the item were about $316.4 million in the year ending on May 29. This was compared with other non-dairy alternatives; sales are still higher coming in at $2.2 billion.

One of the most popular brands is a Swedish company called Oatley. Oatly started selling in the United States in 2017. Oatly also sells ice creams and yogurt. The company is having issues keeping up with high demand, therefore inventory is low in the stores. This benefits other companies vying for the opportunity to reach new customers, and gain market share.

Oatly may have great products, but it flopped with its advertising. Oatly’s commercial with CEO Toni Petersson playing a keyboard and singing a repetitive song, with lyrics “Wow! No Cow,” in a field. Oatly had try to redeem itself and gave away “I totally hated that Oatly commercial” t-shirts after viewers said the commercial was horrible.

Oatly CEO, Toni Peterson says the company is in a “transition” period this year.

The longer their supply chain has trouble meeting demand, consumers will choose other brands like Planet One, Danone, Planet Oat Chobani and Oat Hood.

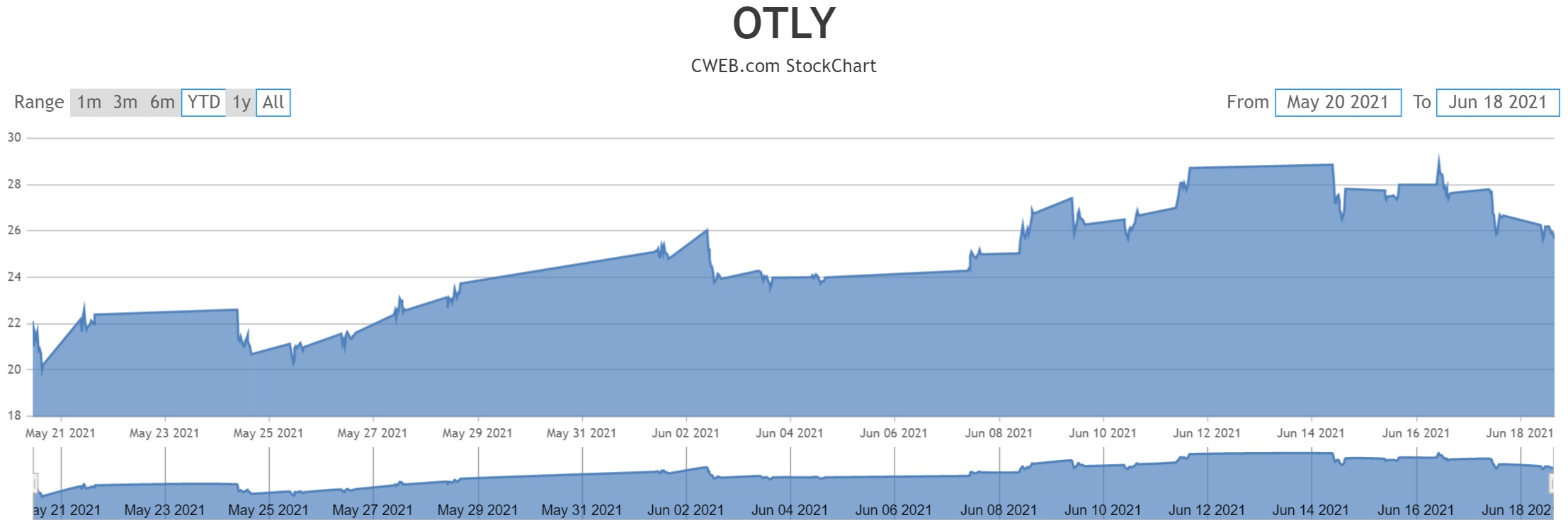

Oatly’s initial public offering (IPO) on May 20,2021 raised $1.4 billion, and its share prices initially set at $17 per share, rose up by 30 percent on the first day of trading, with a potential valuation is $10 billion.

Click for Full Research on Oatly by CWEB.com