The stock price of Deutsche Bank (NYSE:DB) remains below what appears to be fair value. Deutsche Bank has a market leading financing business with a global footprint and unique capabilities.

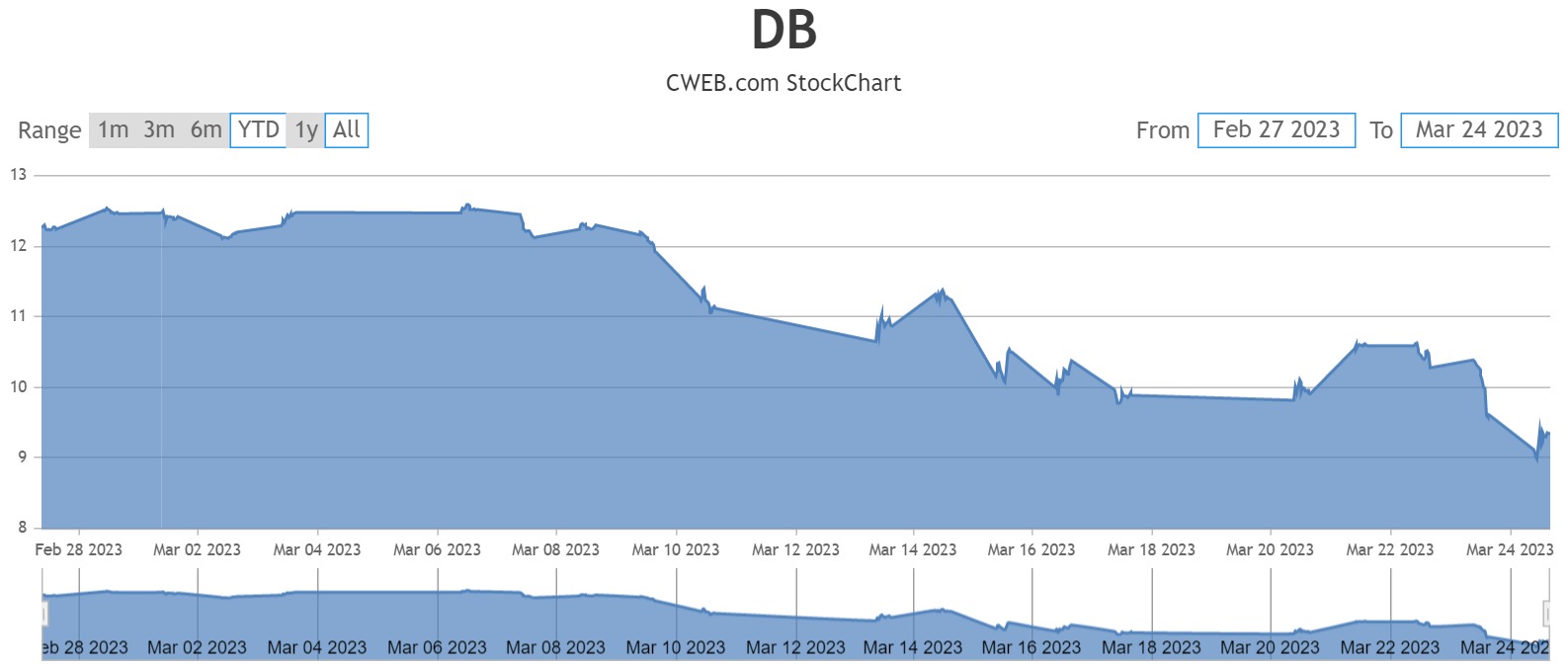

Although the bank’s fundamentals and earnings have improved significantly in recent years, Deutsche Bank’s stock price has remained depressed.

Over the next few years, its sustainable return on equity is projected to be 6-8%, which supports a higher P/BV multiple.

Deutsche Bank will boost investors’ faith in its future success. We have previously examined Deutsche Bank, but since its shares are currently undervalued, it seems like a good time to do so again.

Deutsche Bank’s reorganization efforts over the past few years have been focused on implementing the company’s 2019 business plan. The bank has strengthened its foundation and become much more profitable in recent years. Deutsche Bank shares continue to trade at one of the cheapest valuations in the European banking industry, measured by its price-to-book value ratio of about 0.38x, despite this history. (vs. 0.83x on average for its closest peers).

Given its historical performance, and its potential ‘sustainable’ profitability in the near future, Deutsche Bank is one of the cheapest banks within the European banking industry and relative to its investment banking peer group.

The current consensus among 20 polled investment analysts is to buy stock in Deutsche Bank AG. This rating has held steady since February, when it was unchanged from a rating.

Final conclusion Deutsche Bank (NYSE:DB) at this current valuation is a strong Buy compared to other financial institutions and it is trading below its market value.