Groupon (GRPN) possesses some recession-resistant qualities that the market appears to overlook. Consider the reasons why they could recover from the recent decline.

Wall Street is fond of Groupon Inc. (GRPN). Analysts recommend purchasing stock on average. The average price target is $49, indicating that analysts anticipate the share price to increase 48.54 percent over the next year.

Groupon’s origin story essentially boils down to the company’s provision of online marketing for local businesses, which was out of reach for many small businesses. As a result of partnering with Groupon, local merchants offered discounts to Groupon’s customers in order to attract these new customers. As compensation for providing the platform, Groupon received a portion of the promotional sales, while consumers benefited from the discounts. It was a novel concept that combined the savings associated with bulk purchases with the rapidly expanding e-commerce industry.

Weil Company Inc. increased its holdings in shares of Groupon, Inc. (NASDAQ: GRPN) by 42.6% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. After purchasing an additional 14,600 shares of the coupon company’s stock during the period, the company owned 48,846 shares. As of its most recent SEC filing, Weil Company Inc. owned approximately 0.16% of Groupon worth $389,000 in stock.

Several additional hedge funds have recently altered their holdings of the company. OLD Mission Capital LLC acquired approximately $250,000 worth of new Groupon shares during the second quarter. During the second quarter, Verus Capital Partners LLC acquired a new position in Groupon shares worth approximately $162,000. During the second quarter, Mizuho Markets Americas LLC increased its position in the shares of Groupon by 4.2%. After acquiring an additional 5,100 shares in the preceding quarter, Mizuho Markets Americas LLC now holds 127,917 shares of the coupon company’s stock worth $1,445,000. Ergoteles LLC acquired a new $276,000 stake in Groupon during the first quarter. During the first quarter, Raymond James & Associates purchased a new position in Groupon for approximately $273,000. Institutional investors hold 57.11 percent of the stock.

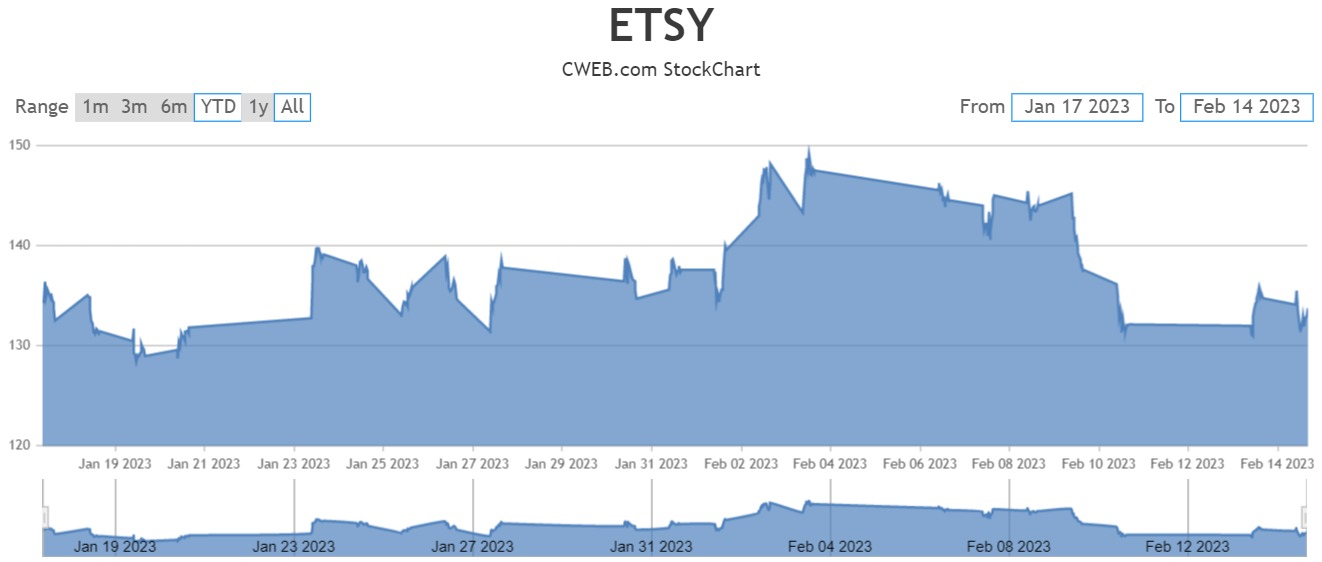

ETSY’s Price to Earnings (PE) ratio is 37.5, which places it above the historical average of approximately 15. Due to investors paying more than the stock is worth in relation to its earnings, ETSY is trading at a low price. ETSY’s trailing twelve-month earnings per share (EPS) of $2.83 does not justify its current market price. The trailing PE ratio does not account for the company’s projected growth rate; consequently, some firms will have high PE ratios as a result of high growth attracting more investors, even if the underlying company has generated low earnings to date.

The 12-month forward PE to Growth (PEG) ratio for ETSY is 6. ETSY is currently overvalued relative to its projected growth, as its PEG ratio exceeds its fair market value of 1.

Summary ETSY’s valuation metrics are weak at its current price due to a PEG ratio that is overvalued due to the company’s robust growth. ETSY’s PE and PEG are lower than the market average, resulting in a valuation score that is below average.

Groupon Director Jan Barta acquired 6,716,966 shares of the company’s stock. The shares were purchased at an average price of $7.28 per share, totaling $48,899,512.48. The director now owns 6,716,966 shares of the company’s stock worth $48,899,512.48 following the completion of the transaction. The purchase was disclosed in a legal filing with the Securities and Exchange Commission, which can be viewed on the SEC’s website. The company’s insiders own 15.90% of its stock.

Other recent Groupon purchases are Maple Rock that added 2 million shares (now Maple rock owns 3million shares – 9.9%) and Morgan Stanly added 1.25 million shares (now owns 1.75million), Intrinsic Edge capital added 1 million shares from BOA, Vanguard, Prentice and RPD. Short on Groupon only covered 200k shares from the last 4 months.

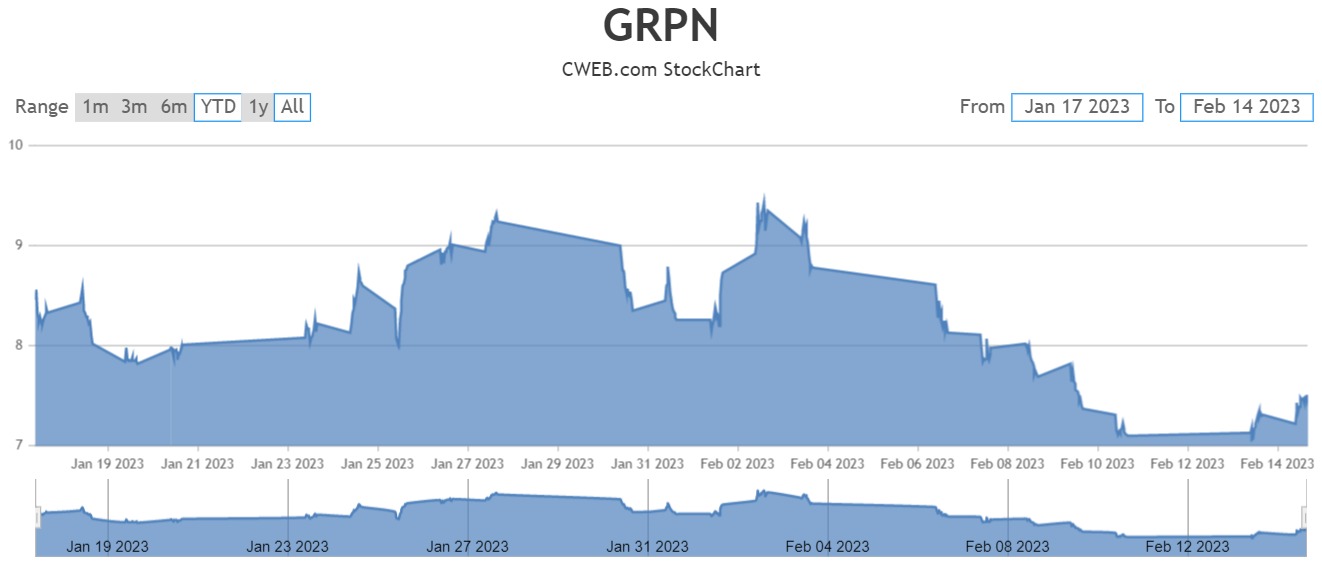

Etsy is currently trading at $133.50 and Groupon is trading currently at $7.53. If you compare both companies Groupon can easily reach over $100 a share by end of 2023 which makes it a better investment and buy opportunity for the savvy investor.

Authors of this Blog own shares: of Groupon and Apple

Celebrity News Update— Premier Jewelry designer and manufacturer fashion house ParisJewelry.com has started manufacturing a new custom line of celebrity jewelry designs with 30% Off and Free Shipping. Replenish Your Body- Refilter Your Health with OrganicGreek.com Vitamin Bottles, Vitamins and Herbs. Become a WebFans Creator and Influencer.

Groupon Stock Could Fly High in the 4th Quarter Despite Recession Fears