Apple (

AAPL) reported its Q3 2021 earnings after the closing bell on Tuesday, beating analysts’ expectations on strong iPhone sales performance and overall revenue growth of 36% year-over-year.

“This quarter, our teams built on a period of unmatched innovation by sharing powerful new products with our users, at a time when using technology to connect people everywhere has never been more important,” Apple CEO Tim Cook said in a statement.

- Revenue: $81.41 billion vs. $73.30 billion estimated, up 36% year-over-year

- iPhone revenue: $39.57 billion vs. $34.01 billion estimated, up 49.78% year-over-year

- Services revenue: $17.48 billion vs. $16.33 billion estimated, up 33% year-over-year

- Other Products revenue: $8.76 billion vs. $7.80 billion estimated, up 40% year-over-year

- Mac revenue:$8.24 billion vs. $8.07 billion estimated, up 16% year-over-year

- iPad revenue: $7.37 billion vs. $7.15 billion estimated, up 12% year-over-year

- Gross margin: 43.3% vs. 41.9% estimated

According to Bloomberg, Apple told its suppliers to build 90 million iPhones. That’s a massive jump from the 75 million the company ordered in 2020.

“Our record June quarter operating performance included new revenue records in each of our geographic segments, double-digit growth in each of our product categories, and a new all-time high for our installed base of active devices,” said Luca Maestri, Apple’s CFO. “We generated $21 billion of operating cash flow, returned nearly $29 billion to our shareholders during the quarter, and continued to make significant investments across our business to support our long-term growth plans.”

Apple’s board of directors has declared a cash dividend of $0.22 per share of the Company’s common stock. The dividend is payable on August 12, 2021 to shareholders of record as of the close of business on August 9, 2021.

Apple will provide live streaming of its Q3 2021 financial results conference call beginning at 2:00 p.m. PT on July 27, 2021 at

apple.com/investor/earnings-call. This webcast will also be available for replay for approximately two weeks thereafter.

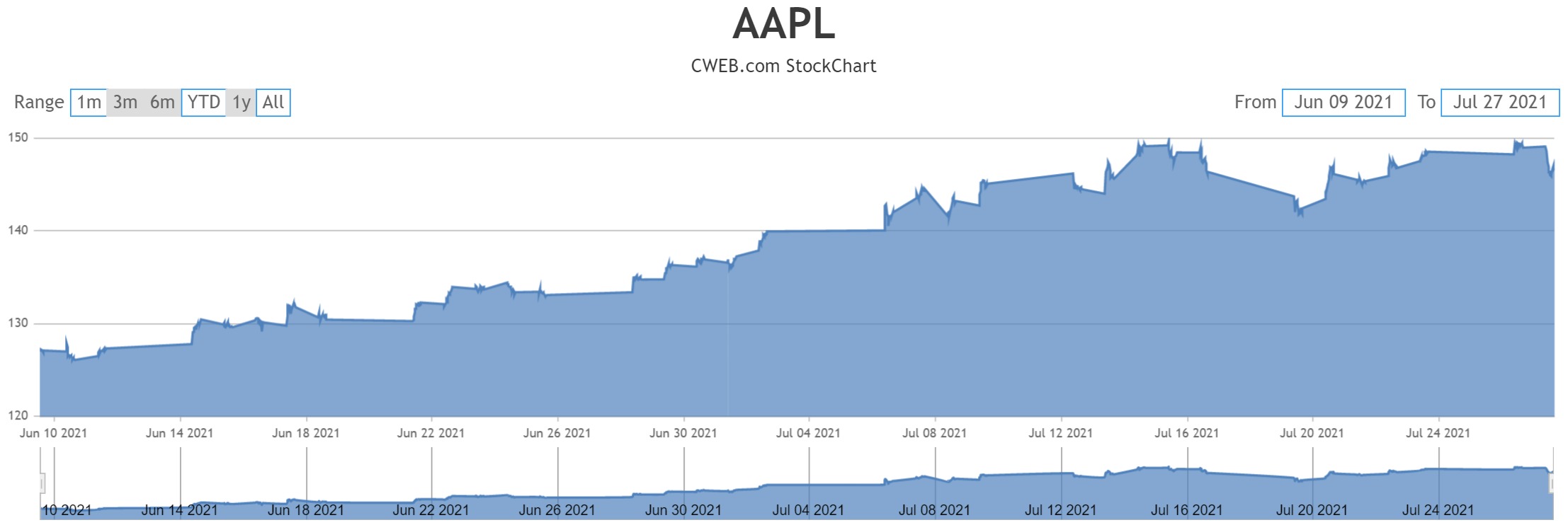

CWEB Analyst’s have initiated a Buy Rating for Apple (

AAPL)

and potential upside of $1200 in 2021. Apple will also be releasing a similar feature to instagram, snapchat hat that will work with its own iMessage application. And with over 1 Billion iPhone users this will be a huge addition to Apple’s revenue.

Subscribe to get Latest News Updates