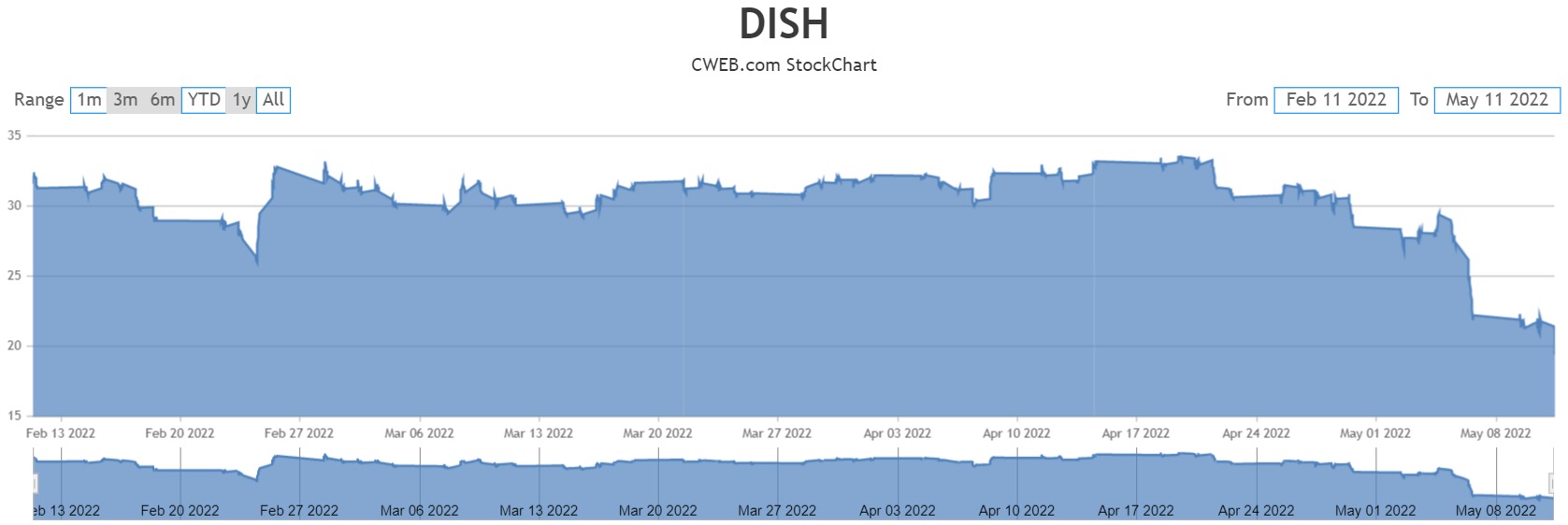

DISH Network Corporation (NASDAQ:DISH) shares lost more than 20% since Thursday’s close on the company’s reported Q1 results, with EPS of $0.68 coming in worse than the consensus estimate of $0.74. Revenue was $4.33 billion, compared to the consensus estimate of $4.38 billion.

Deutsche Bank analysts shared their views following the results, noting that the company’s management needs to provide the market with details of the company’s business plan on its Analyst Day tomorrow, if management wants to optimize its access to and cost of capital.

The analysts believe that investors would value the company to share its view of some of the key financial drivers, namely (1) the size of the addressable market over the next 5-7 years, (2) the potential market share it could achieve over that same time frame, (3) expected EBITDA margin levels at scale, (4) how much it will invest in Capex and Opex into the network buildout.

According to the analysts, the more investors understand the company’s plans, the more flexibility it will have to fund the wireless business plan (and at a lower cost), whether it is through debt, convert, or equity.