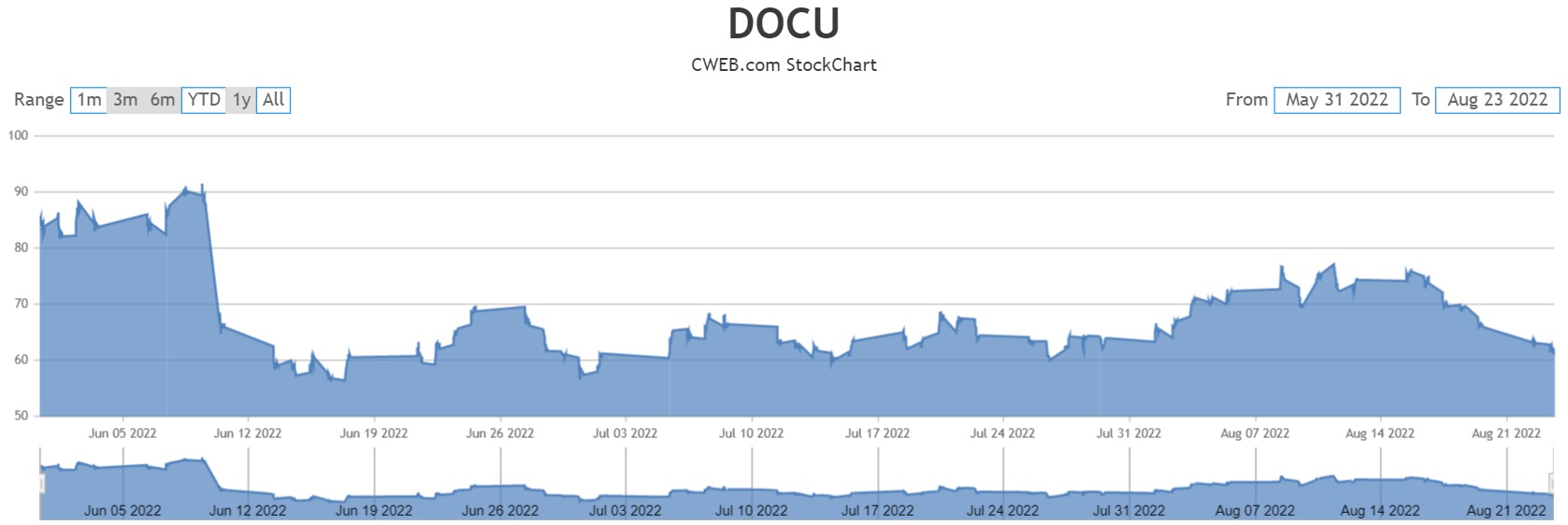

RBC Capital analysts downgraded DocuSign, Inc. (NASDAQ:DOCU) to sector perform from outperform and lowered their price target to $65 from $80.

The analysts mentioned several reasons for the downgrade, including (1) a long path to turnaround, which is effectively on hold without a CEO, (2) execution issues and high employee turnover reducing the analyst’s confidence in numbers, and (3) tough setup in the near-term. While the analysts believe their estimated numbers are de-risked (6% revenue growth and 3% billings growth in 2024), they are well below the street estimates, which is looking for 11% revenue growth and 13% billings growth. Given management has guided to 6% billings growth in the second half of the year, the analysts believe it is hard to underwrite those expectations.

Furthermore, the analysts believe the company needs to build credibility with investors, making a turnaround tough to get behind.