RBC Capital analysts provided their key takeaways from Dover Corporation (NYSE:DOV) Analysts Meeting on March 8, where the company reaffirmed 2023 guidance and set bullish 2025 targets.

The facility tour showcased the highly profitable CPC business that manufactures one-time-use connectors, pumps and flowmeters for biopharma, medical, and industrial applications. The new 2025 targets of 4%-6% organic growth, segment margins, and 25%-35% incrementals were decidedly positive.

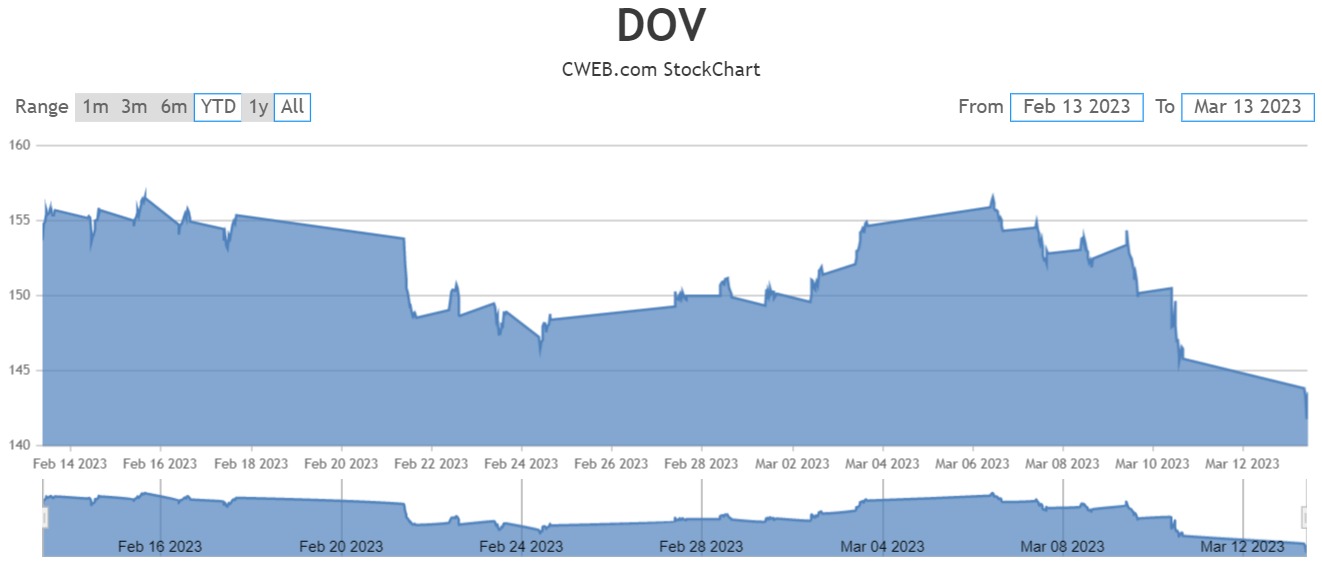

According to the analysts, the company looks nicely leveraged to multi-year secular trends, including data centers, EV infrastructure, biopharma production, and clean energy. It remains M&A-focused, targeting higher growth end markets. Divestitures look to be less of a priority. The analysts see risk/reward as balanced and reiterate their Sector Perform rating and $145 price target on the stock.

Groupon Is Hinting at Strong Q4 Earnings on 3/15/203. Why does it matter?