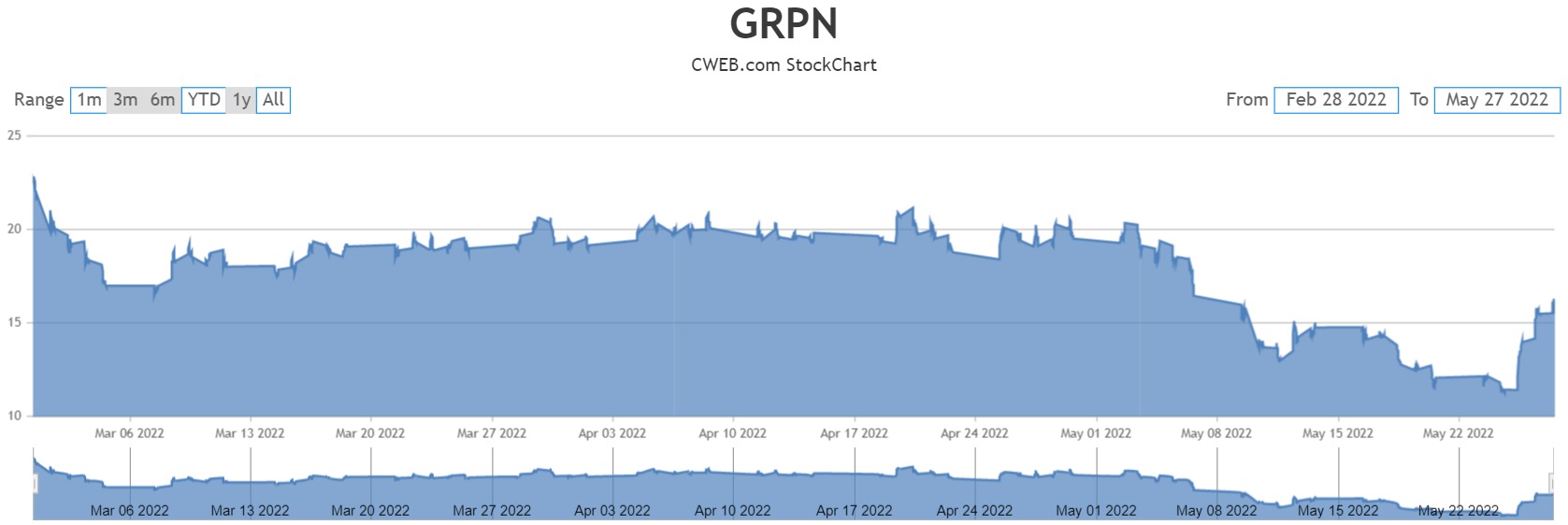

On Thursday, Groupon shares rose by 12 percent after beneficial owner Jan Barta bought $5.3 million shares. According to an Securities and Exchange Commission filing that was dated May 23, Jan Barta, who is a 10 percent owner of Groupon, bought 458, 794 shares of the company at a price of $11.29 to $12.53 per share.

On Thursday, Groupon shares rose by 12 percent after beneficial owner Jan Barta bought $5.3 million shares. According to an Securities and Exchange Commission filing that was dated May 23, Jan Barta, who is a 10 percent owner of Groupon, bought 458, 794 shares of the company at a price of $11.29 to $12.53 per share.

Groupon has reported a drop in the expected EPS for the first quarter. The final year 2022 sales guidance was also a little below estimates by analysts. However, the company is hoping for better results.

Groupon is a large marketplace that brings together merchants and consumers to a common platform. Its online store offers discounts in various categories of goods and services. It operates in two major segments: America and International. Goods and services can be accessed through mobile or website.

The American based company has a current market cap of $463.78 million.

A number of large investors have recently added to their stakes in GRPN. Dark Forest Capital Management LP purchased a new position in shares of Groupon in the third quarter valued at $25,000. Point72 Hong Kong Ltd bought a new stake in Groupon during the first quarter worth about $50,000. Quantbot Technologies LP bought a new stake in Groupon during the first quarter worth about $55,000.

Prescience Point Capital Management predicts that Groupon share value should be in the $70-$100 range, after Groupon confirmed its stake in SumUpon, on a bullish trend. This is an estimation and not financial advice.

Groupon’s public disclosure of its stake is positive news. It could be a catalyst to drive up the share price of Groupon. Many analysts had not estimated a bullish trend for the company. Prescience Point has been emphasizing the company’s value due to its hidden asset from several weeks.

Groupon features deals: everyday deals, trending deals, featured deals, popular deals, new deals, region based deals and more in various categories including food and drink, beauty, experiences, gifts and more. Earnings and growth had seen a downward trend due to the lockdowns as a result of the pandemic. However, as everything has been opening up, the company is seeing green shoots and hopes to reach pre pandemic levels of growth; later if not sooner.