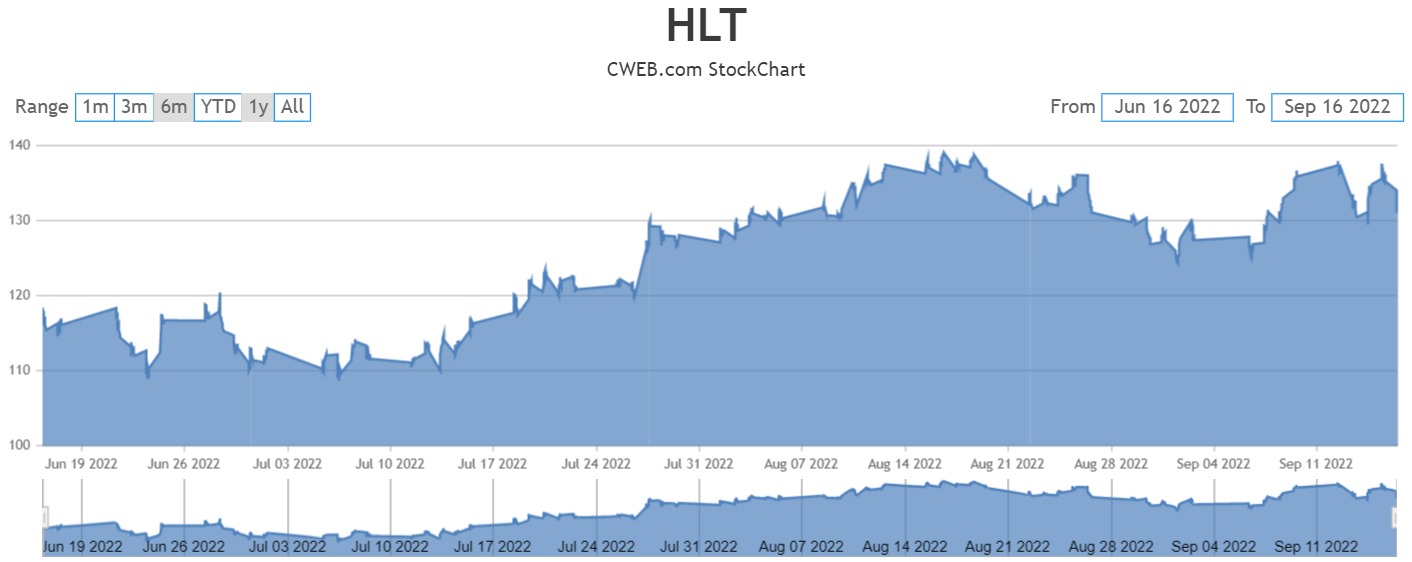

Berenberg Bank analysts upgraded Hilton Worldwide Holdings Inc (NYSE:HLT) to buy from hold and raised their price target to $152 from $140.

According to the analysts, the strength of Hilton’s asset-light portfolio is demonstrated by the fact that despite a 56% decline in RevPAR (revenue per available room) the company remained comfortably cash-flow-positive.

According to the analysts, RevPAR still has some way to go in the recovery. While they are conscious that there are mounting concerns about the macro environment, the analysts believe that even if headwinds materialize, RevPAR will continue on a positive trajectory in 2023 and beyond.

The company is set to return between $1.5 billion and $1.9 billion in 2022 and analysts expect this to be over $2 billion in 2023. This will be achieved against the backdrop of net unit growth above 5% and robust earnings growth moving forward, even in the event of a weakening macro situation.

Celebrity Paris Hilton speaks about Web3, NFTs and more, while snapping selfies too