Is Verizon Undervalued At Its Current Price – CWEB.com

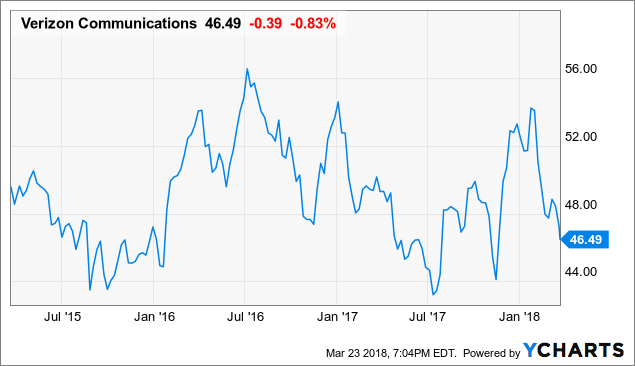

Verizon Communications Inc. (VZ) has been in a solid downtrend since early February, and it is presently influencing another bearish break to out of a multi-week consolidation and now underneath a key up-drifting support level. Treasury yields are moving higher which is putting weight on the solid 4.99% profit yield (VZ) is at present advertising.

The 4.99%dividend yield may resemble sufficiently appealing profits that lure new speculators, It’s vital to see that a rising profit yield is essentially a side-effect of a stock that is dropping. We anticipate that (VZ) will keep tumbling to levels of support $46.

Verizon Communications Inc. (VZ) stock has had a battle so far in 2018. The shorts are wagering enormous bets that rising interest rates will keep on pressuring Verizon.

Short sellers relying upon rising interest loan rates, seem to view the AT&T Inc. (T) -/ Time Warner Inc. (TWX) – antitrust trial as a potential bullish close term impetus for the stock and are concentrating on Verizon.

CWEB Analyst’s have Reiterated a Buy Rating for Verizon Communications Inc. (VZ) and a Price Target of $60 within 12 months.

Read Full Article and Videos CWEB.com – Trending News, Blog, Shopping