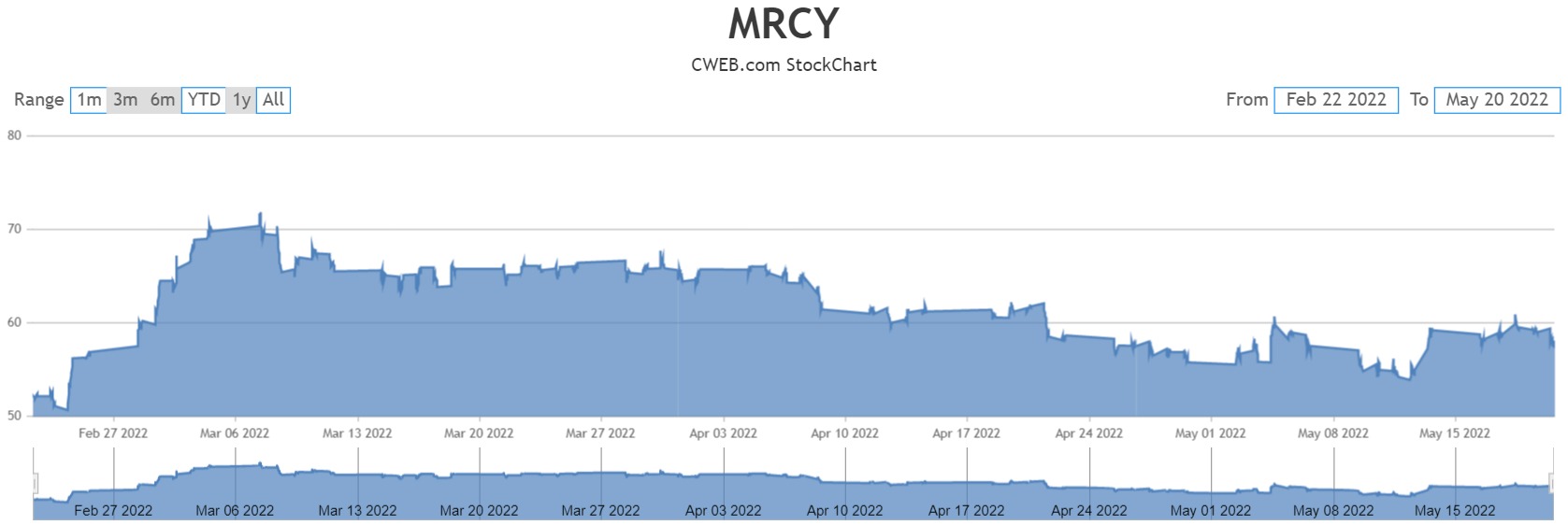

RBC Capital analysts upgraded Mercury Systems, Inc. (NASDAQ:MRCY) to outperform from sector perform and raised their price target to $72 from $60.

The company reported its Q3 results at the start of the month, with EPS of $0.57 coming in worse than the consensus of $0.59. Revenue came in at $253.1 million, compared to the consensus estimate of $249.38 million.

The poor 2022 results reflected delays in several leading programs, supply chain and labor challenges, and the fact that the 2022 budget was not appropriated until the end of March 2022.

After the disappointing 2022, analysts at RBC Capital believe the company is well positioned to return to at least mid-single-digits organic growth, execution (margins and free cash flow) improvement, and the activist presence provides a floor on the valuation.