Tonight Senate Democrats have reached a new agreement with Sen. Joe Manchin (D., W.Va.) to extend the weekly unemployment benefits at $300 a week through Sept. 6, according to a Democratic aide.

The compromise agreement extends the federal unemployment benefit at $300 per week through the end of August, according to a Democratic aide not authorized to speak on the record. The first $10,200 of unemployment benefits would be non-taxable for households with incomes under $150,000, the aide said. The original version of the bill passed by the House last week had the benefit at $400 per week running through the end of August.

The agreement also extends a tax break for businesses for an additional year through 2026.

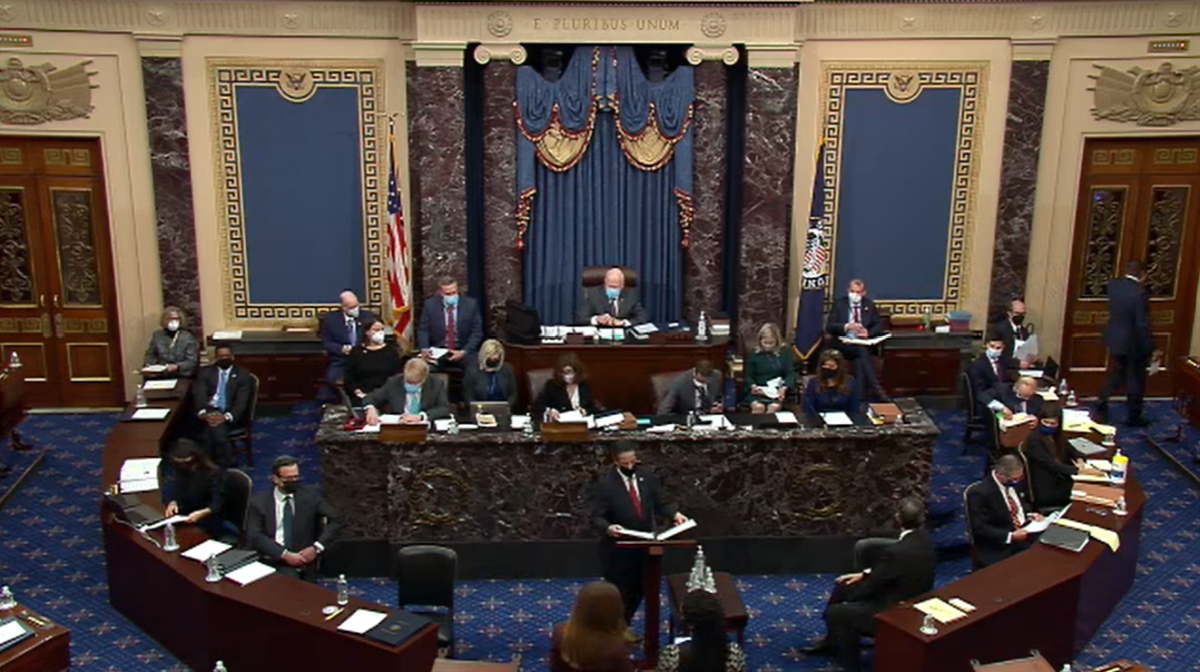

Senators voted 58-42 Friday morning against increasing the minimum wage, but the vote hasn’t been formally gaveled to a close while Senate leadership negotiate the process for the remainder of the vote.

The eight Democratic caucus members who voted against the measure are:

- Sen. Jon Tester, D-Mont.

- Sen. Joe Manchin, D-W.V.

- Sen. Jeanne Shaheen, D-N.H.

- Sen. Kyrsten Sinema, D-Ariz.

- Sen. Angus King, D-Maine (King caucuses with Democrats)

- Sen. Tom Carper, D-Del.

- Sen. Chris Coons, D-Del.

- Sen. Maggie Hassan, D-N.H.

If you’re unemployed:

The pandemic unemployment assistance program will be available for up to 74 weeks in the states where people still out of work and have run out of their unemployment benefits. The benefit will apply to independent contractors, gig workers, and freelancers. They will receive an extra $400 a week on top of the benefits they are entitled to.

If you are ill:

The bill may include an incentive to employers to provide paid sick and family leave if you are stuck at home caring for a loved one or taking care of a child school if a school is closed. However, employers are not obligated to pay this incentive but are offered to give the benefit to the employee. It will provide tax credits to employers do too to offer the benefit to October 1st 202i

If you lack health insurance:

Health insurance enrollees will pay maximum of 8.5% of their income for federal premium subsidy could be Affordable Care Act, which will stay in effect for two years. That’s reduced from about 10% individuals who earn $51,000 and families who earn 104,800 dollar will become eligible for assisted. Those that fall in the lower incomes here will have their premium completely eliminate. Premiums will be eliminated for those who are collecting unemployment benefits till 2021.

Federal assistance may also be available to those that have COBRA insurance and are still on their employer’s health insurance plans. If an employee was laid off, they would pay 15% of the premium in September 2021.

If you’re behind on rent or mortgage:

The bill includes $19.1 billion to state and local governments help low-income citizens those that were affected unable to pay their rent due to being unemployed. The bill also helps with payments for utility bills and back rent.

If you have children:

Tax credits would you give in the families that qualify for each child up to $3600 if they are under six years old and $3000.00 for each child under the age of 18 and up. The bill would provide $39 billion to child care providers, partially to help families struggling to pay the cost.

If you own a small business:

Help is on the way for a $15 billion to the Emergency Injury Disaster Loan program, which provides long-term, low-interest loans from the Small Business Administration. There is a $25 billion for a new grant program specifically for bars and restaurants. The Paycheck Protection Program is accepting applications for second-round loans. The bill provides an additional $7 billion and non-profit organizations become more eligible.

$175 million is earmarked to be used for outreach and promotion, creating a Community Navigator Program for businesses that become eligible.