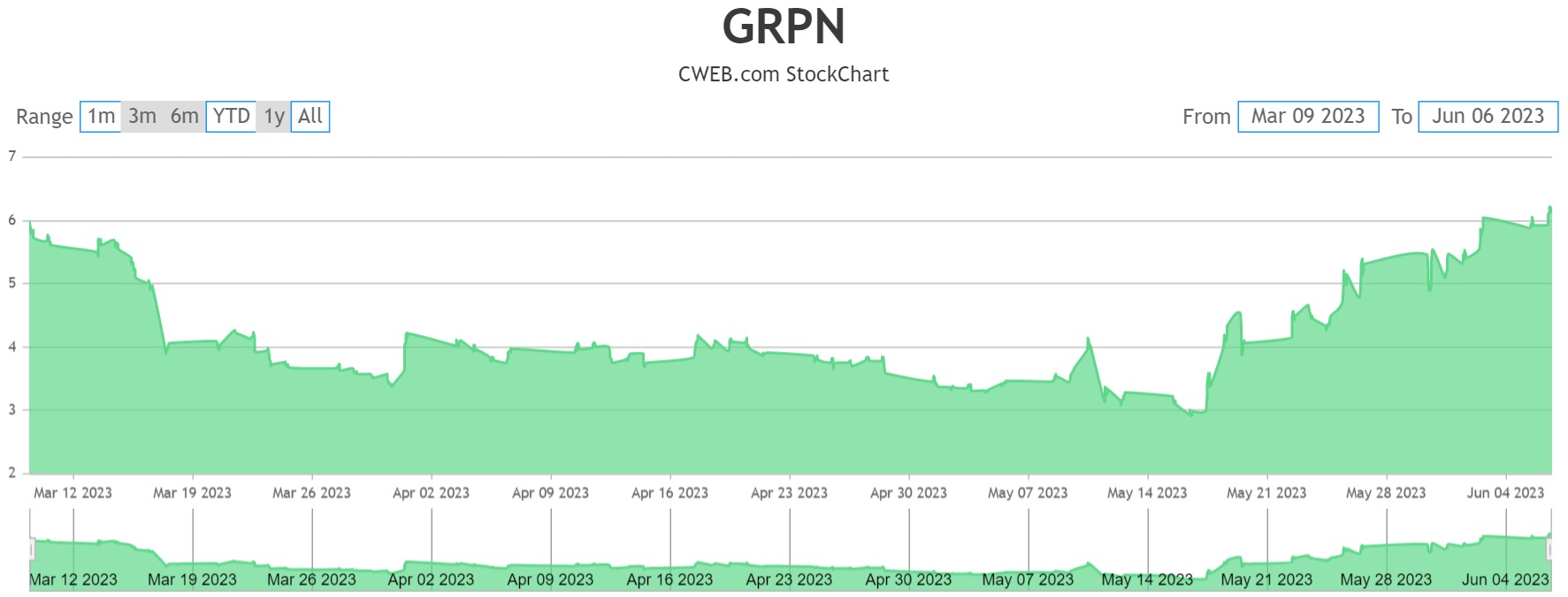

In the months of May and June, shares of Groupon (NASDAQ: GRPN) have returned to over 73% to investors. These are encouraging signs of a recovery for this major player in the e-commerce industry.

According to Groupon’s first quarter 2023 financial results, it will have saved $250 million in annualized costs by the end of 2023. Additionally, the management has revealed its transformation plan to revamp Groupon and reposition it for future expansion.

Approximately 18.2 million customers were active on Groupon at the end of the first quarter, down from 22.2 million at the same time last year. International Active Local Customers grew year-over-year for the fifth consecutive quarter.

The second stage of Groupon, Inc.’s multi-phase restructuring plan, which is a component of the company’s comprehensive cost-savings plan, was approved by the board of directors on January 25, 2023. In an effort to reduce expenses, Groupon announced last week that it had reduced its workforce by another 500 employees. In August 2022, the e-commerce company cut 500 jobs, or about 15% of its total workforce. According to the company’s SEC filing, the job cuts will result in annual cost savings of millions.

The Company also intends to carry out additional non-payroll actions outlined in the 2022 Cost Savings Plan, such as lowering costs associated with professional services, technology, and software. Additional annualized cost savings of $30.0 million are anticipated as a result of these actions.

Groupon has approximately 20 million customers. More than 15 million of these users have been on the platform for five years or longer. The majority of users are active buyers and sellers on the platform. Sometime back, Prescience Point had said that this information demonstrated that the business was a force to be reckoned with. Market analysts had also noticed that Groupon’s core business was undervalued.

By putting more of an emphasis on lower funnel performance channels and switching from incrementality to ROI targets in Q1, Groupon increased the effectiveness of its marketing expenditure. This led to advances in efficiency, particularly in search engine marketing, and a decrease in marketing expenditure as a percentage of gross earnings. Prior to shifting back to mid- and upper-funnel channels, Groupon is now concentrating on increasing returns in performance channels.

Groupon thus continues to move towards its vision to create a marketplace where customers can purchase goods and services that add value to life and make it more interesting.

Etsy is currently trading at $90; Target (TGT) is trending around $140.Wish is trading around $8 Groupon is trading currently at $6.20.

Groupon can easily bounce back by the end of 2023 which makes it a good investment and a good opportunity for the savvy investor.

Disclaimers: CWEB.com is responsible for the production and distribution of this content. CWEB. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by CWEB. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall CWEB be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by CWEB, including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. CWEB. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, CWEB, its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. CWEB has been compensated up to ten-thousand-dollars cash via wire transfer by a third party to produce and syndicate content for Nightfood Holdings, Inc.. for a period of one month ending on June 10, 2023. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.