UPS (NYSE:UPS) today announced second-quarter 2021 consolidated revenue of $23.4 billion, with a 14.5% increase over the second quarter of 2020. Consolidated operating profit came in at $3.3 billion, which increased up to 47.3% compared to the second quarter of 2020 and rising up 40.8% on an adjusted basis. Diluted earnings per share came in at $3.05 for the quarter, 50.2% above the same period in 2020, and up 43.7% on an adjusted basis.

Consolidated Revenues of $23.4B, up 14.5% from Last Year

Consolidated Operating Profit of $3.3B, up 47.3% from Last Year; Up 40.8% on an Adjusted* Basis

Diluted EPS of $3.05, up 50.2% from Last Year; Adjusted Diluted EPS Up 43.7% to $3.06

In the second quarter of 2021, GAAP results include after-tax transformation and other charges of $11 million, equivalent to $0.01 per share. In the second quarter, USPS completed its divestiture of UPS Freight on April 30. The sale triggered re-measurement of certain U.S. pension and postretirement benefit plans. As a result, UPS pension and postretirement liabilities decreased by $2.1 billion. The calculation had no meaningful impact to the company’s consolidated second-quarter net earnings. Year-to-date cash from operations was $8.5 billion, up 42.2% compared to the same period in 2020. Free cash flow came in at $6.8 billion, a 74.7% increase above the first six months of 2020.

“I want to thank all UPSers for executing our strategy and delivering high service levels, which fueled record financial results in the second quarter,” said Carol Tomé, UPS chief executive officer. “Through our better not bigger framework, we are moving our world forward by delivering what matters.

The Future

For 2021, the company is projecting consolidated operating margin roughly about .7% and return on invested capital of 28%. UPS capital allocation plans for 2021 will include:

Capital expenditures will be about $4.0 billion.

Long-term debt repayments of $2.55 billion have been finalized.

Effective tax rate for the remainder of the year is expected to be around 23%.

Image Open Grid Scheduler / Grid

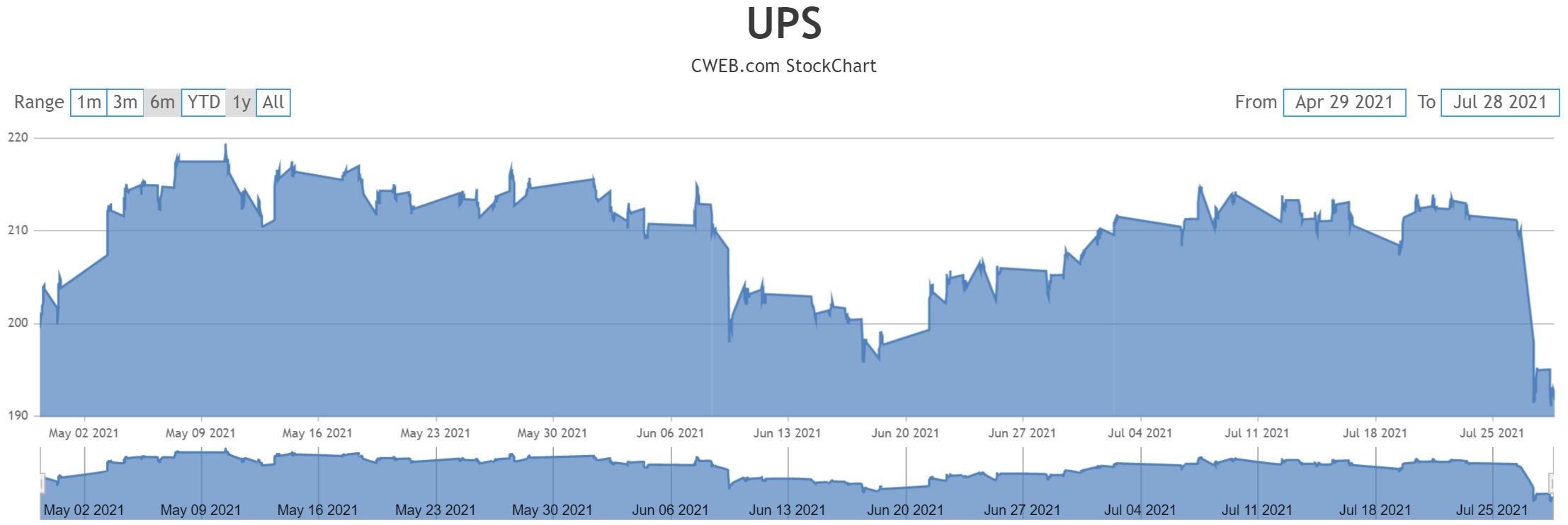

CWEB Analyst’s have initiated a Buy Rating for UPS (NYSE:UPS) and potential upside of $250 by 2021. Strong Holiday sales are going to be around the corner and this impact the next quarter.