The Walt Disney Company (DIS) today reported earnings for its second fiscal quarter ended April 3, 2021. Diluted earnings per share (EPS) from continuing operations for the quarter increased to $0.50 from $0.26 in the prior-year quarter. Excluding certain items(1), diluted EPS for the quarter increased 32% to $0.79 from $0.60 in the prior-year quarter. EPS from continuing operations for the six months ended April 3, 2021 decreased 64% to $0.52 from $1.43 in the prior-year period. Excluding certain items(1), EPS for the six months decreased 48% to $1.11 from $2.13 in the prior-year period.

Results for the quarter and six months ended April 3, 2021 were adversely impacted by the novel coronavirus (COVID-19). The most significant impact was at the Disney Parks, Experiences and Products segment where since late in the second quarter of fiscal 2020, our parks and resorts have been closed or operating at significantly reduced capacity and our cruise ship sailings have been suspended.

“We’re pleased to see more encouraging signs of recovery across our businesses, and we remain focused on ramping up our operations while also fueling long-term growth for the Company,” said Bob Chapek, Chief Executive Officer, The Walt Disney Company. “This is clearly reflected in the reopening of our theme parks and resorts, increased production at our studios, the continued success of our streaming services, and the expansion of our unrivaled portfolio of multiyear sports rights deals for ESPN and ESPN+.”

The most significant impact on operating income in the current quarter from COVID-19 was at the Disney Parks, Experiences and Products segment due to revenue lost as a result of the closures and reduced operating capacities. We estimate an additional $1.2 billion impact on the Disney Parks, Experiences and Products segment operating income compared to the prior-year quarter. The impacts of

COVID-19 on our Disney Media and Entertainment Distribution segment, compared to the prior-year quarter, were less significant as lower revenues across film and television distribution windows due to the deferral or cancellation of significant film releases were largely offset by a reduction in the related costs.

International Channels revenues for the quarter decreased 4% to $1.3 billion and operating income increased 27% to $348 million. The increase in operating income was driven by lower programming and production costs and an increase in advertising revenue, partially offset by lower affiliate revenue. The decrease in programming and production costs was driven by a higher percentage of content costs being allocated to Disney+ as we continue to launch the service in additional markets, and lower costs as a result of channel closures. Advertising revenue growth was due to an increase in average viewership. The decrease in affiliate revenue was due to channel closures and an unfavorable foreign currency impact.

The Walt Disney Company, together with its subsidiaries, operates as an entertainment company worldwide. The company’s Media Networks segment operates domestic cable networks under the Disney, ESPN, Freeform, FX, and National Geographic brands; and television broadcast network under the ABC brand, as well as eight owned domestic television stations. This segment is also involved in the television production and distribution; and operation of National Geographic magazines. Its Parks, Experiences and Products segment operates theme parks and resorts, such as Walt Disney World Resort in Florida; Disneyland Resort in California; Disneyland Paris; Hong Kong Disneyland Resort; and Shanghai Disney Resort; Disney Cruise Line, Disney Vacation Club, National Geographic Expeditions, and Adventures by Disney; and Aulani, a Disney resort and spa in Hawaii, as well as licenses its intellectual property to a third party for the operations of the Tokyo Disney Resort in Japan. The company’s Studio Entertainment segment produces and distributes motion pictures under the Walt Disney Pictures, Twentieth Century Fox, Marvel, Lucasfilm, Pixar, Fox Searchlight Pictures, and Blue Sky Studios banners; develops, produces, and licenses live entertainment events; produces and distributes music; and provides post-production services, including visual and audio effects. Its Direct-To-Consumer & International segment operates international television networks and channels comprising Disney, ESPN, Fox, National Geographic, Star, and Other India Channels; direct-to-consumer streaming services consisting of Disney +, ESPN+, Hotstar, and Hulu; and operates branded apps and Websites, such as Disney Movie Club and Disney Digital Network, as well as provides streaming technology support services. The company was founded in 1923 and is based in Burbank, California.

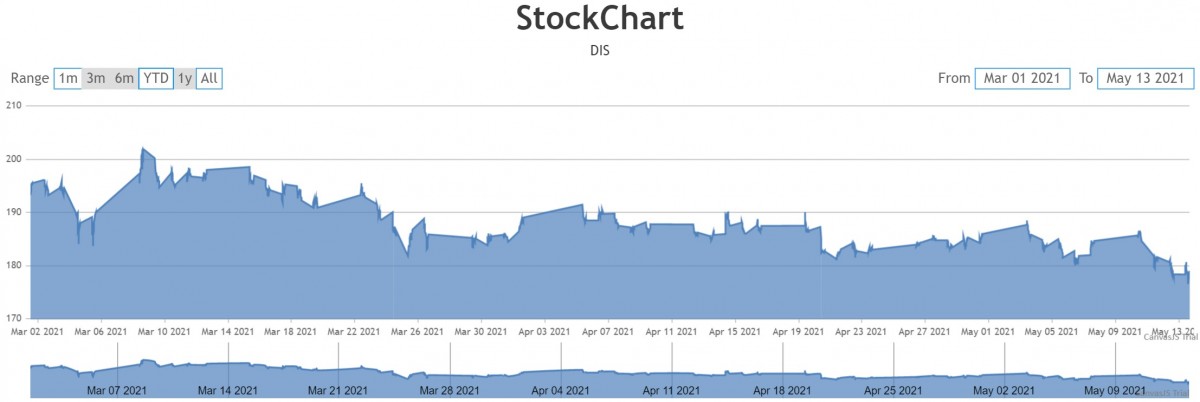

CWEB Analyst’s have initiated a BUY Rating for Walt Disney Company (DIS) and potential upside of $259 in 2021. The fundamentals of the company are to strong and cash on hand has increased compare to previous quarter. We believe Q2 will be the real break for the company expanding retail operations. Covid-19 had major impact on Disney numbers but the guidance has change and un masking will be the next big money opportunity for Disney.