While Meta’s disappointed mixed earnings release, there is an opportunity to buy the stock.

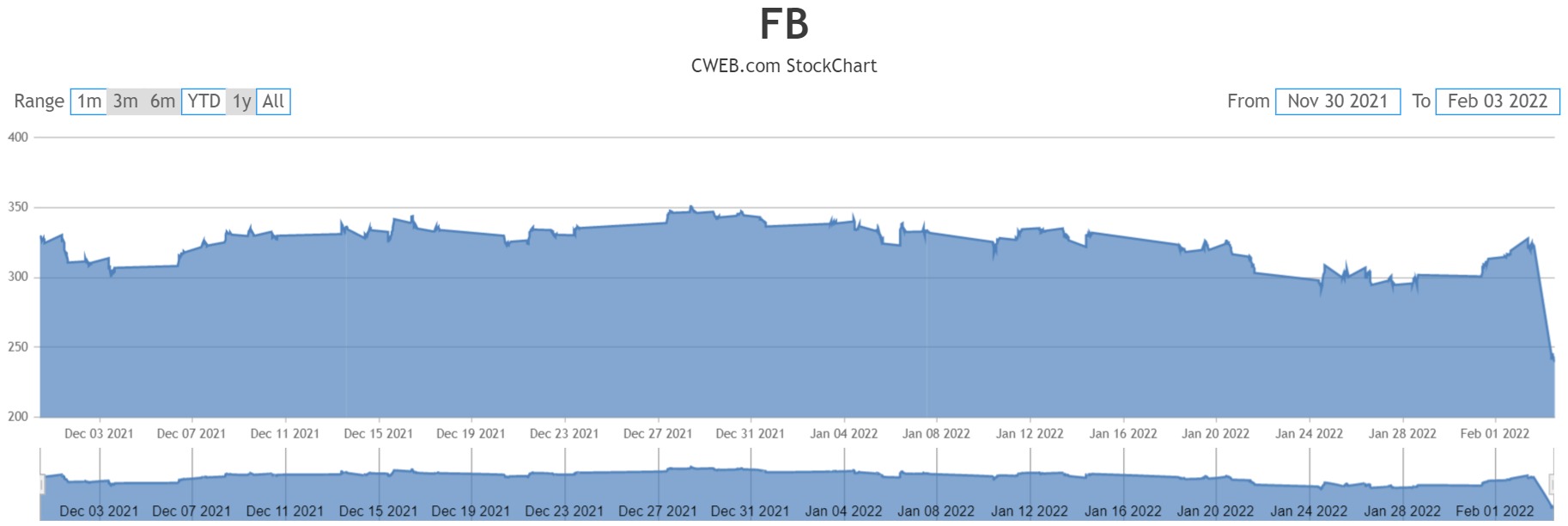

Don’t let the shock of the 22% after hours stock drop on Wednesday turn you off from this stock. Today we see Meta fall Thursday after the company forecasted weaker-than-expected revenue growth in the next quarter. However, even as it takes a large drop today for a company of it’s size in the U.S, here is your opportunity to reap the growth benefits Meta has to offer.

$210 billion from its market cap was lost, bringing it to about $689 billion.

Meta Platforms Inc. NASDAQ: FB beat on revenue but had a miss on earnings- and it was due to a huge spending budget on the metaverse for the period. Meta slightly missed on EPS by only 5% and was able to make a bit of a beat on revenue for the quarter, at $33.67 billion vs. $33.4 billion estimated.

Meta reported that revenue surged 20% for the quarter, and costs did jump to 38%, which resulted in a year-over-year earnings decline. The decline was caused by a very large investment in R&D. If management could have reduced what is spent on metaverse spending it likely would have also beat on EPS.

Total fourth-quarter revenue came in at $33.7 billion, up 20% year over year. Advertising revenue increased 25% as businesses continued to allocate their ad dollars to Meta’s platforms. The monthly active people count increased to 3.59 billion during the quarter, from 3.58 billion in the previous quarter and 3.3 billion the year before. Average revenue generated per person increased 9% from last year and 15% from the prior quarter, indicative of healthy advertising demand. With increase in investments in metaverse and the firm’s advertising offerings, operating margin declined nearly five percentage points to around 33% during the quarter. Source Morningstar

Where is the strength of the company? Advertising. Facebook did admit that users were spending less time on the site which affects advertising. But what the company has planned ahead for advertising in its new “metaverse” business model, it could take it to new heights.

OrganicGreek.com — Vitamin Bottles

Let’s also discuss the media and how it affect sentiment. Before the fourth quarter earnings release the news stories were negative due to social media’s effect on people’s health, in particular Instagram and WhatsApp.

Bright lights- Have faith in Zuckerberg. Remember Cambridge Analytics. Everyone thought Facebook was done as the story crazed through the media, but Zuckerberg came back strong. He’s going to compete against with TikTok to drive ad revenue.

Before earnings were released the talk among analysts was that tracking changes in Apple’s (NASDAQ:AAPL) app would affect revenue, and in fact it grew pretty nicely.

CNBC reported, macroeconomic challenges like inflation and supply chain disruptions, are weighing on advertiser budgets.

What the top analysts are saying.

Monness analyst Brian White stated that Apple’s App Tracking Transparency framework could remain a “headwind” for Meta Platforms. However, he maintained a Buy rating on FB stock and stated that it “represents an attractive value for a company so entrenched in the digital ad trend and well positioned for long term, digital transformation opportunities (e.g., metaverse).”

Along with White, Doug Anmuth of J.P. Morgan also reiterated his Buy rating on FB stock as he sees the company progressing well against Apple’s new framework. Further, he remains upbeat over the prospects of Reels. Reels is the primary driver for engagement growth on Meta’s Instagram, according to management. Source: Nasdaq.com

The Nasdaq article also mentions- There is a strong Buy consensus rating is based on 26 Buys and 5 Holds. FB’s stock prediction on TipRanks shows decent upside potential. The average Meta Platforms price target of $406.75 implies 27.9% upside potential to current levels.

Meta Platforms (FB) near-term uncertainty is high due to challenges posed by video app TikTok, ad revenue issues linked to Apple’s (AAPL) IDFA device tracker, and softer ad demand but the company should be able to “execute through these challenges,” Morgan Stanley said in a note Thursday. Morgan Stanley said it remains bullish on Meta as it’s trading at a “rare” about nine times next 12 months EBITDA and about seven times 2023 EBITDA. The analysts noted it has only traded below about nine times EBITDA twice in its history and has never traded at about seven times. Source: Charles Schwab.