The Home Depot ® (NYSE:HD) the world’s largest home improvement retailer, today reported sales of $37.5 billion for the first quarter of fiscal 2021, an increase of

$9.2 billion, or 32.7 percent from the first quarter of fiscal 2020. Comparable sales for the first quarter of fiscal 2021 increased 31.0 percent, and comparable sales in the U.S. increased 29.9 percent.

Net earnings for the first quarter of fiscal 2021 were $4.1 billion, or $3.86 per diluted share, compared with net earnings of $2.2 billion, or $2.08 per diluted share, in the same period of fiscal 2020. For the first quarter of fiscal 2021, diluted earnings per share increased 85.6 percent from the same period in the prior year.

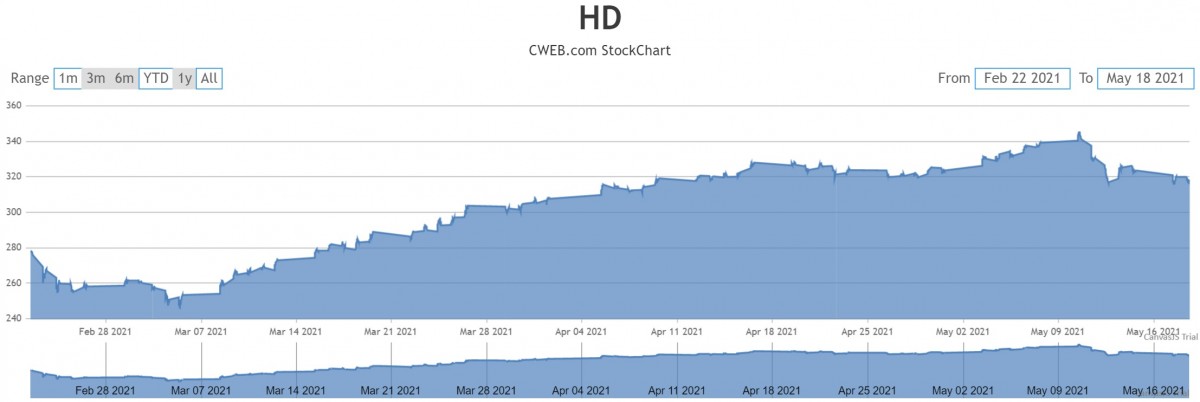

Click Here For Full Stock Research on Home Depot by CWEB

“Fiscal 2021 is off to a strong start as we continue to build on the momentum from our strategic investments and effectively manage the unprecedented demand for home improvement projects,” said Craig Menear, chairman and CEO. “I am proud of the resilience and strength our associates have continued to demonstrate, and I would like to thank them and our supplier partners for their hard work and dedication to our customers.”

At the end of the first quarter, the Company operated a total of 2,298 retail stores in all 50 states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, 10 Canadian provinces and Mexico. The Company employs approximately 500,000 associates. The Home Depot’s stock is traded on the New York Stock Exchange (NYSE: HD) and is included in the Dow Jones industrial average and Standard & Poor’s 500 index.

CWEB Analyst’s have initiated a BUY Rating for Home Depot ® (NYSE:HD) . The fundamentals of the company are to strong and revenue has also increased for Home Depot in the first quarter of 2021.